YEAR

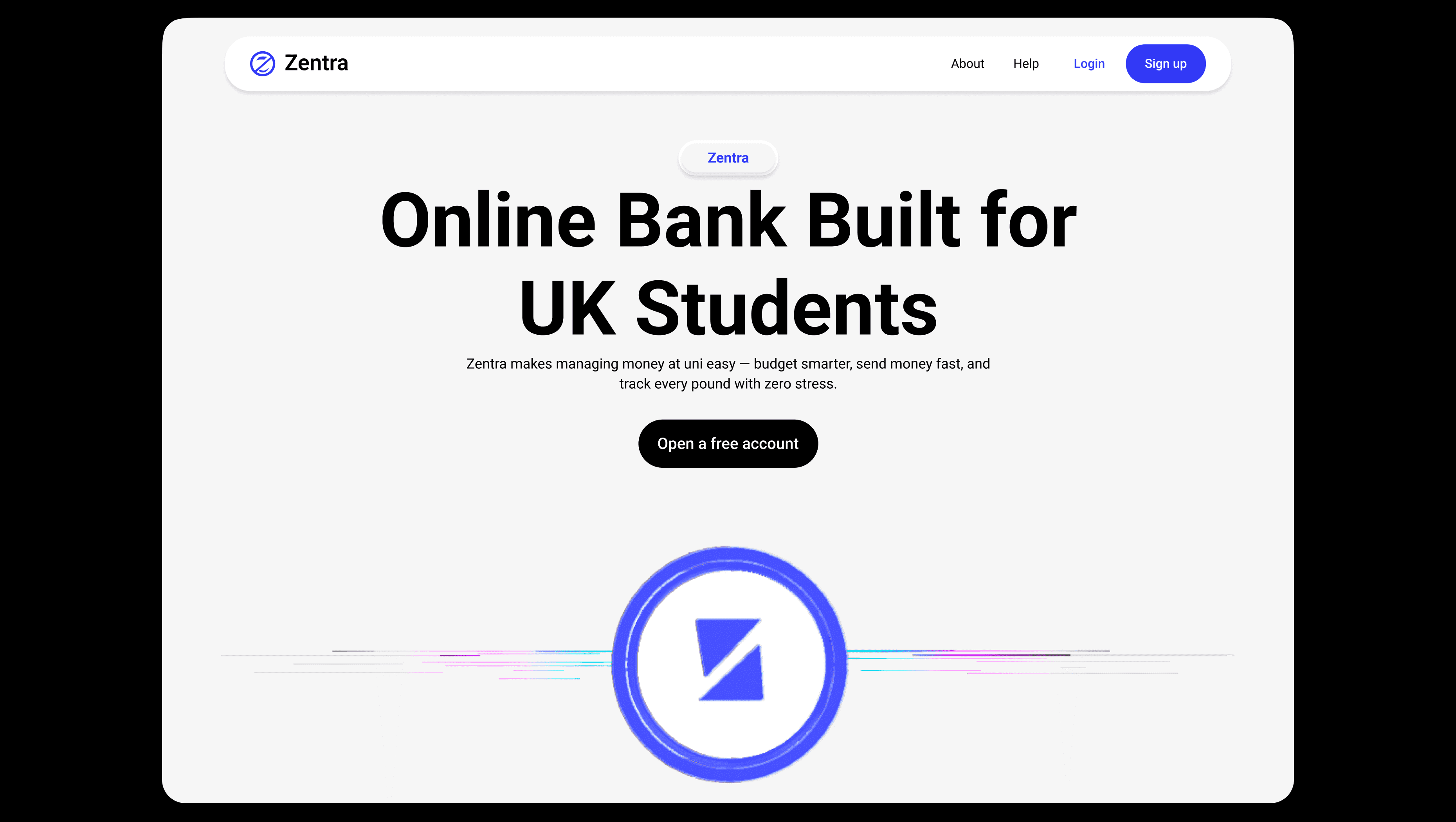

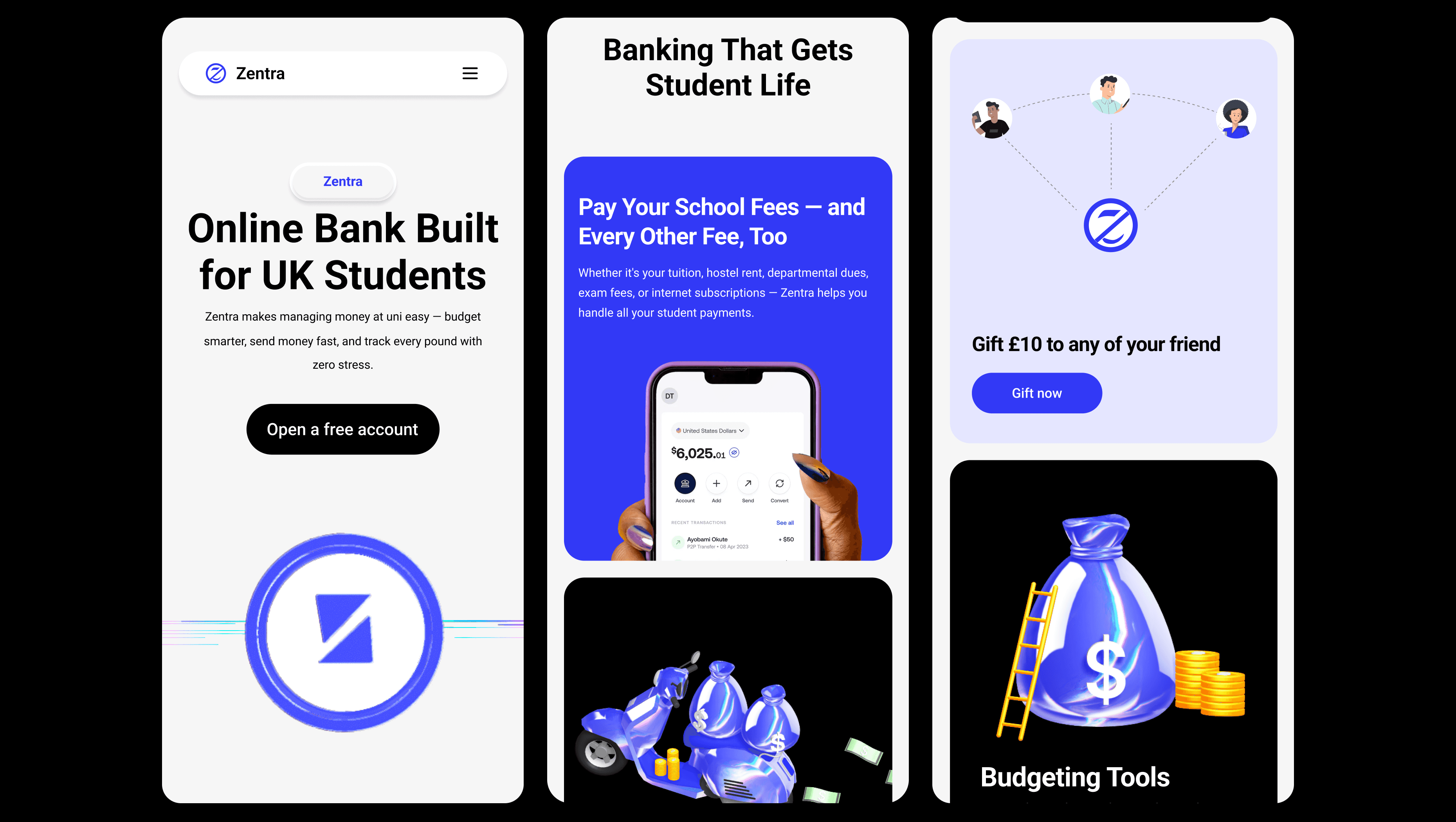

Zentra is a Gen-z digital banking platform designed specifically for UK students, which helps them to manage their finances, pay tuition fees, hostel fees and all school-related fees thereby allowing them to handle all transactions.

The client envisioned a platform that would empower students so the goal of this project was to design a digital banking platform exclusively for students in the UK, addressing their unique financial challenges in managing education-related expenses. enabling them to track, manage, and pay for all their school-related expenses in one place.

The Strategy & Ideation

The goal is to help UK students feel in control, informed, and confident about their finances not overwhelmed by them as that has been the major challenge. so design such platform we narrow down to three key highligts which are,

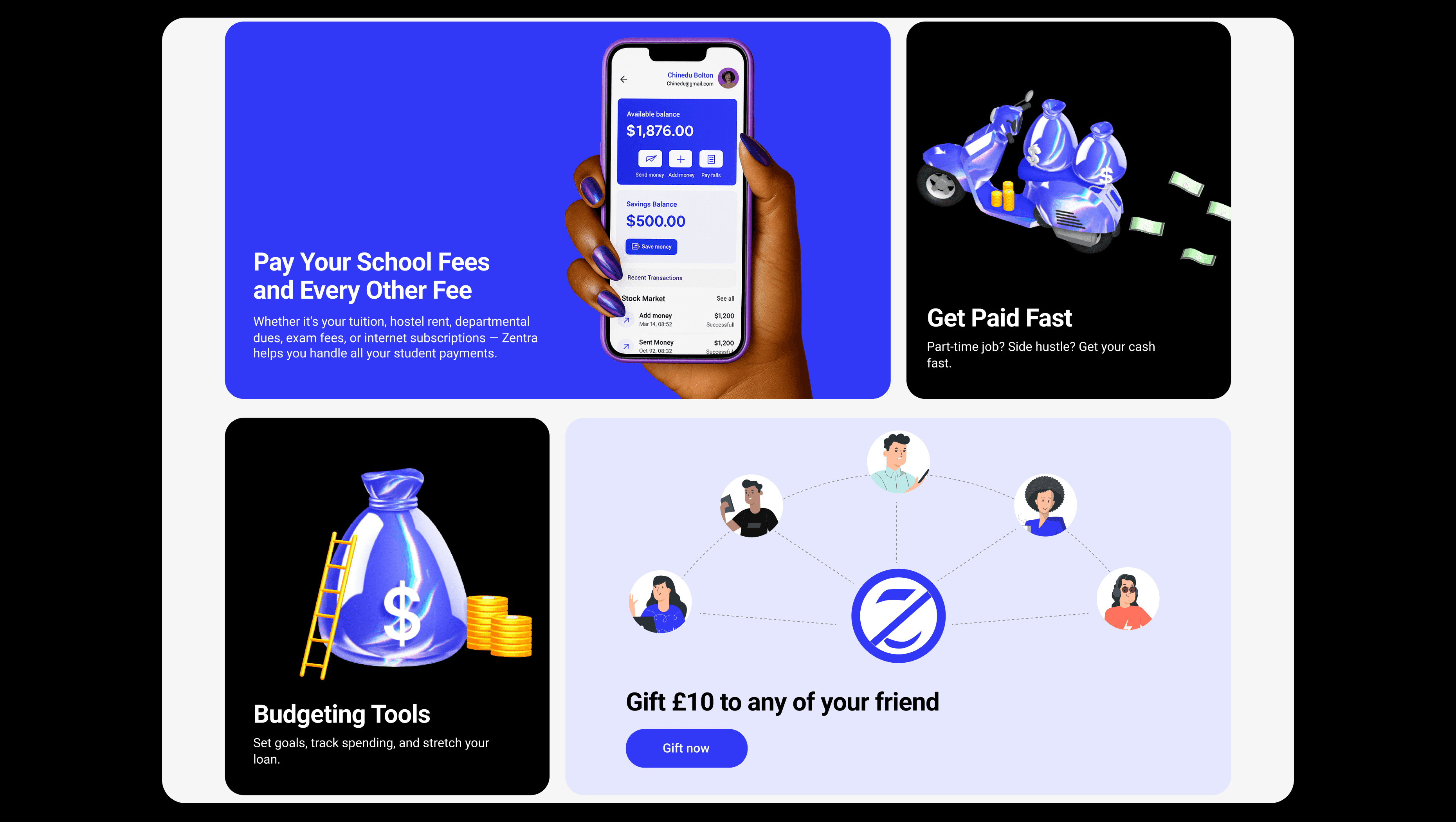

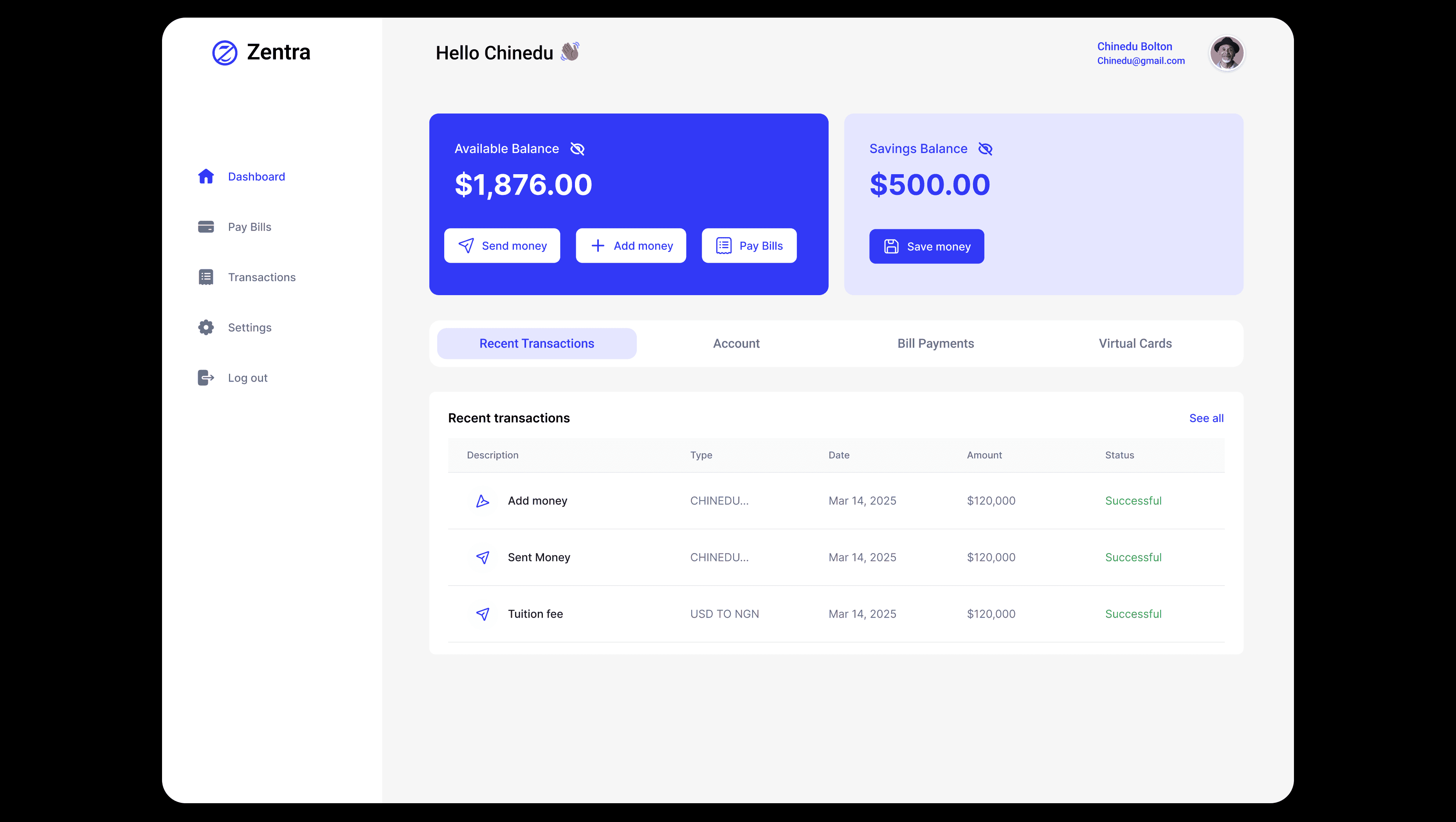

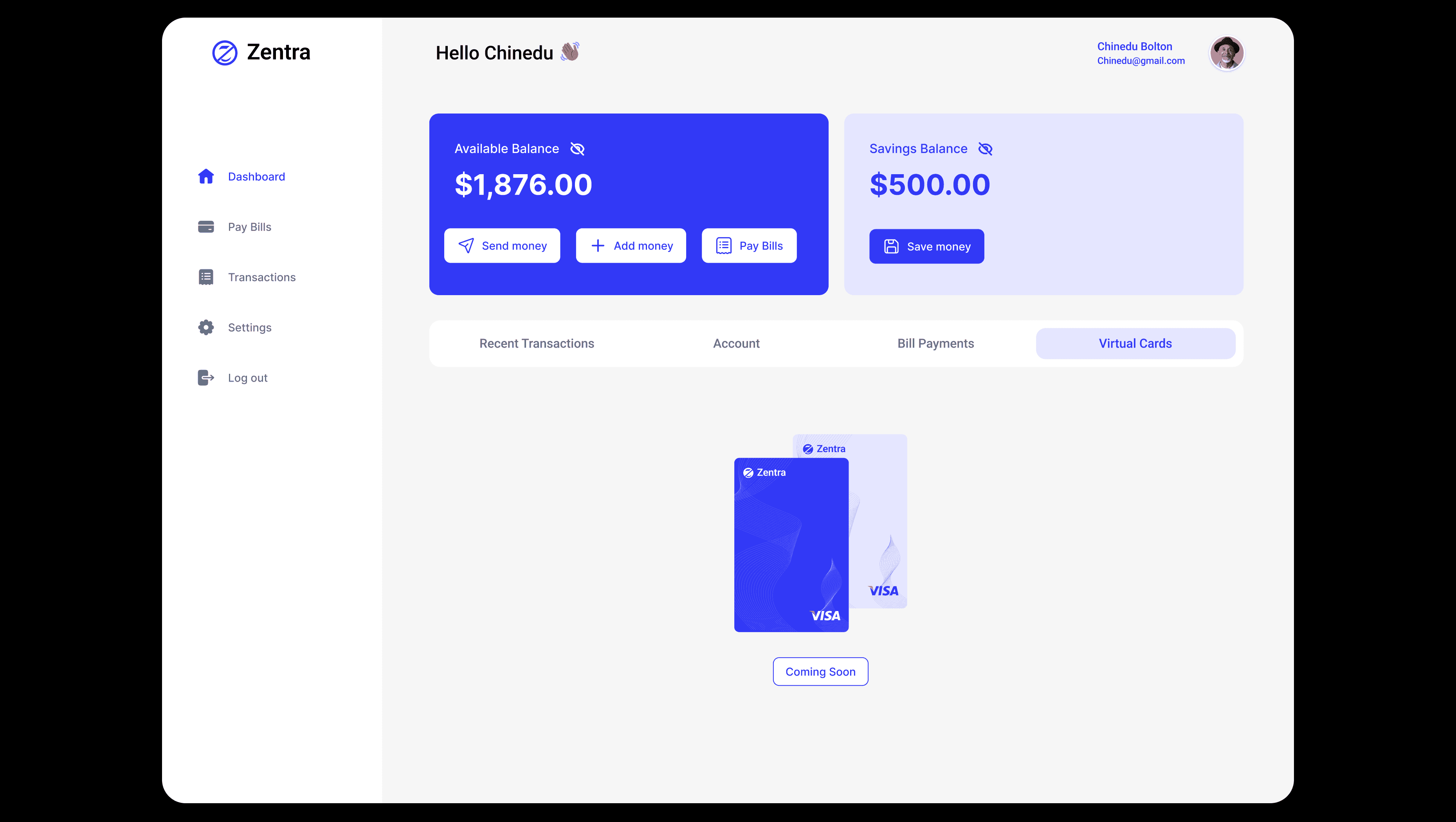

Financial Clarity: students do lack visibility into where their money goes. so we provide clear breakdowns of expenses, balances, and due payments in one dashboard.

Unified Payments: Students manage multiple scattered fees be it tuition, hostel, departmental dues, and utilities. so we consolidate these into a single payment system.

Decision-Making: By combining tracking tools, smart reminders, and budgeting insights, it will encourage better spending habits and responsible financial behavior.

Design Execution

The visual designs are fragments of the in depth research carried. So I focused on creating a clean, student-friendly(gen-z) banking experience that feels both secure and interactive. So students can pay tuition fees, hostel accommodation, exam fees, and even track student loans, the platform simplifies money management and make financial transparency a core part of the student experience.